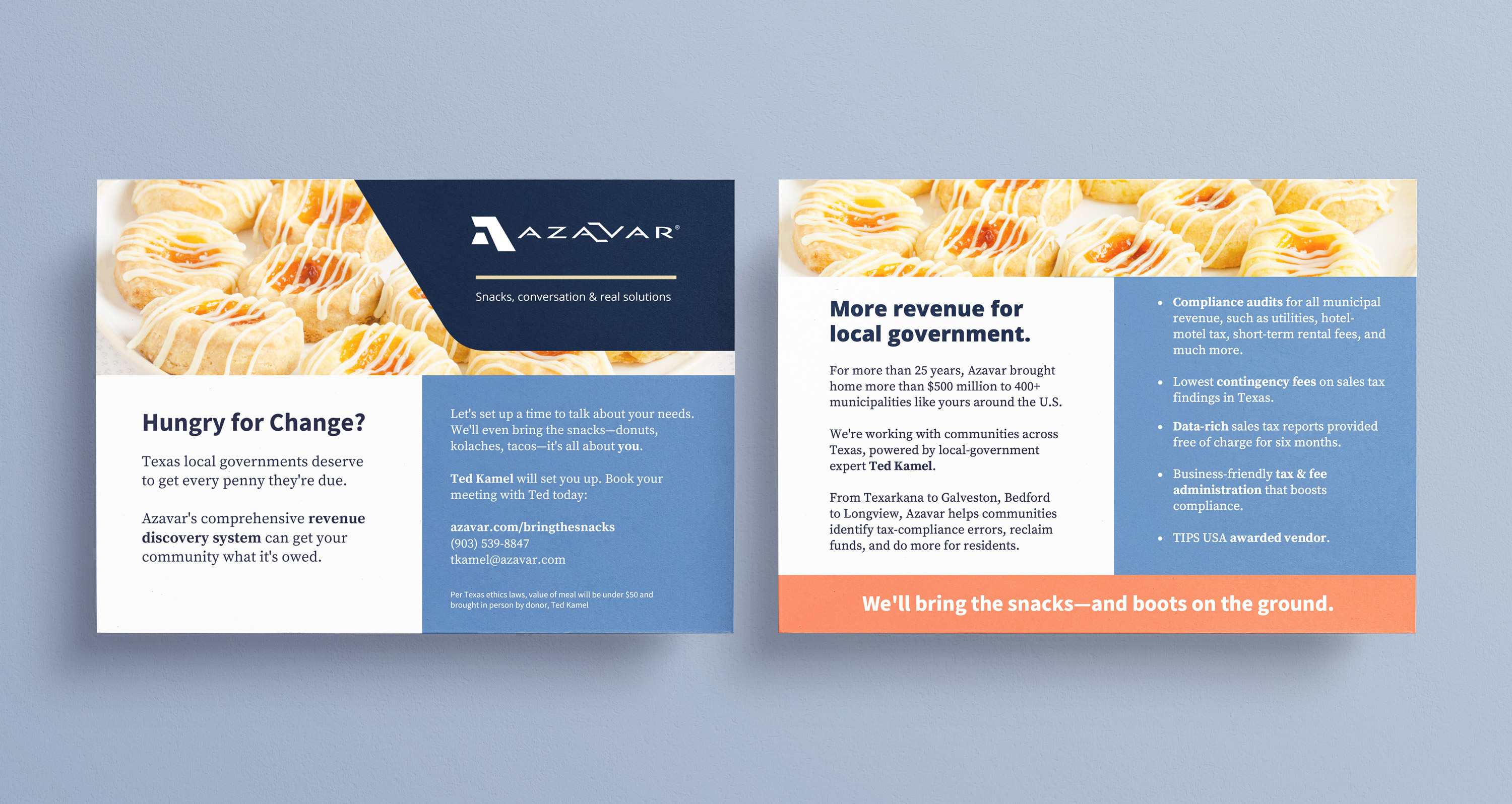

Revenue expert Ted Kamel is bringing sweet treats and real talk to governments across Texas.

Pick the date and time that works for your team. We’ll bring the snacks and the answers.*

Not meeting in person yet? We can set up a remote-based meeting, too.*

For more than 25 years, Azavar has worked with 450+ communities across the country to review revenue—and Ted has nearly two decades as a Texas auditor under his belt. We’ve returned more than $500 million to municipalities across America.

Ask Ted how we found $70K for Dayton, Texas in just the past 18 months. It’s adding up quick!

* Public officials may accept food as long as the donor is present and the value is less than $50. Due to Texas ethics laws, we are not able to provide food for remote meetings.